Concise project reporting to executives is critical to success across your project portfolio. Get the information right, and reports become a communication vehicle where executives have the information they need to track progress, identify risks and opportunities, and understand resource capacity. It also helps project managers and the entire PMO accurately address questions about how quickly projects can be completed, how efficiently staff can be managed, and where there are potential risks to project success. On the other hand, reporting on the wrong metrics or using inaccurate data when providing executives with portfolio updates can lead to poor decision-making, wasted time, and even project failures.

This post will help you get executive reporting right, including key metrics to track and convey and how to deliver actionable insights most effectively.

Why Portfolio Updates Are Critical for Executives

Think of project portfolio updates as your organization’s vital signs. Just as a doctor monitors key health indicators, executives track project metrics, resource utilization, and risk factors to understand organizational health. For example, when a CIO receives updates showing that three AI implementation projects are competing for the same specialized developers, decisions can quickly be made to reallocate resources or adjust timelines to prevent staffing bottlenecks.

Portfolio updates are also a reality check for strategic alignment. Understanding the progress of all projects under management enables proactive prioritization and staffing of new initiatives based on the company’s overarching goals. Good portfolio management ensures that:

- Resources flow to initiatives that best support strategic goals

- Projects remain aligned with changing market conditions

- Leadership can quickly identify and correct strategic drift

Knowing what data to deliver and when is critical. Whether you’re delivering weekly project status reports to surface in-flight variances in planned vs. projected timelines, or monthly budget vs. actual reporting, effective portfolio updates should enable:

- Quick identification of emerging risks to address and prevent them

- Proactive resource reallocation to address shifts in project timelines

- Early detection of market opportunities

- Better coordination across departments

10 Key Metrics and Data Executives Expect and Need

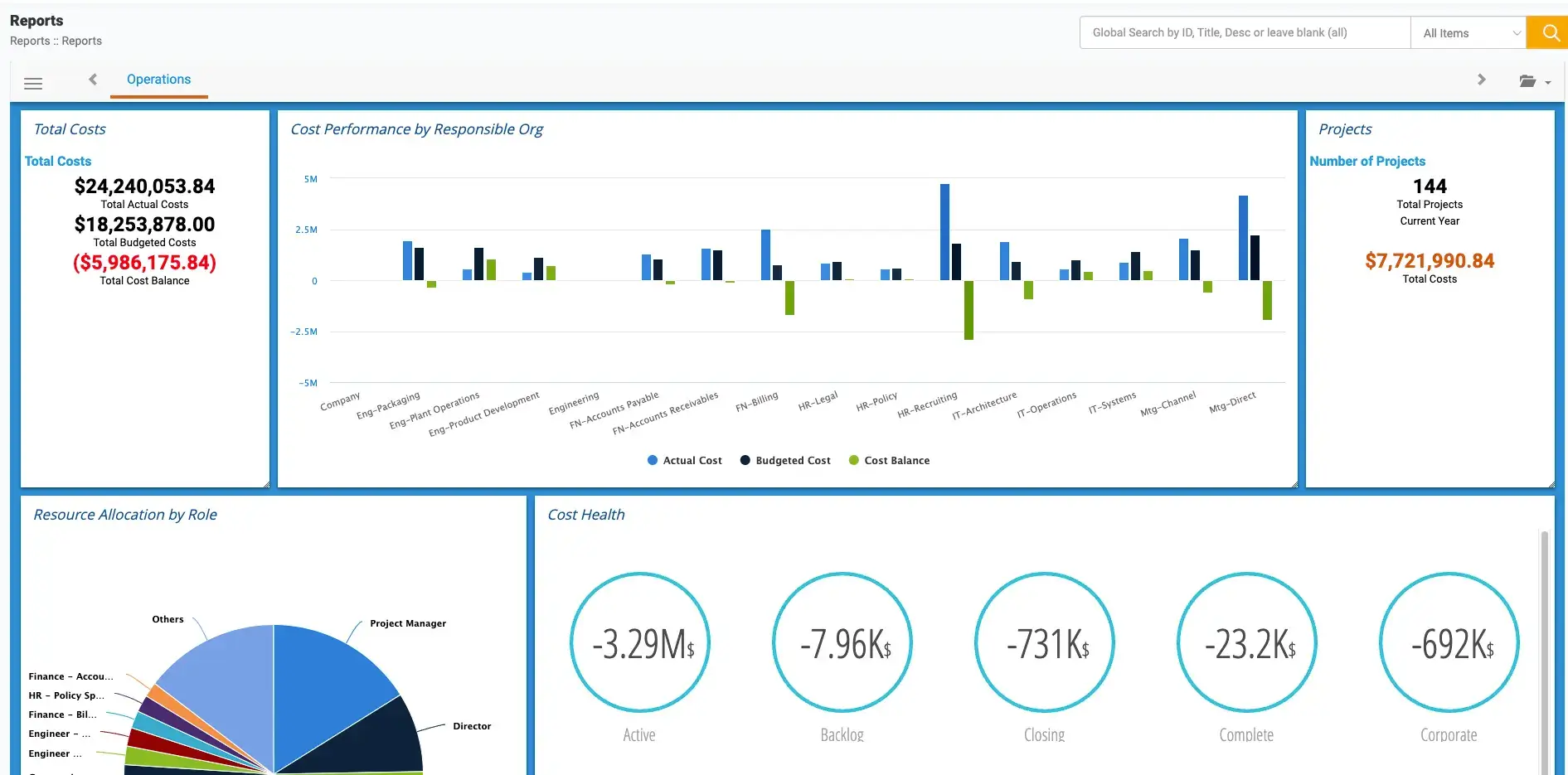

For complex portfolios, custom dashes are a way to quickly and accurately communicate key information to executives

While every company will have different priorities, some metrics are common to most organizations. Overall these 10 key metrics should be taken into account when considering what to track and report on:

- Project performance metrics. Reporting on project budgets, timelines, and deliverables for executives is often done as a rollup of performance rather than a granular view of data, but the ability to drill into data is also important

- Key performance indicators (KPIs) that monitor project health and success across the portfolio may be a blend of project performance metrics. For example, a company may want to track a KPI related to portfolio balance metrics to understand project distribution across different categories like risk levels, technology types, and business units,

- Financial metrics like ROI, budget vs. actual, and cost variances are used to understand the financial performance of the portfolio

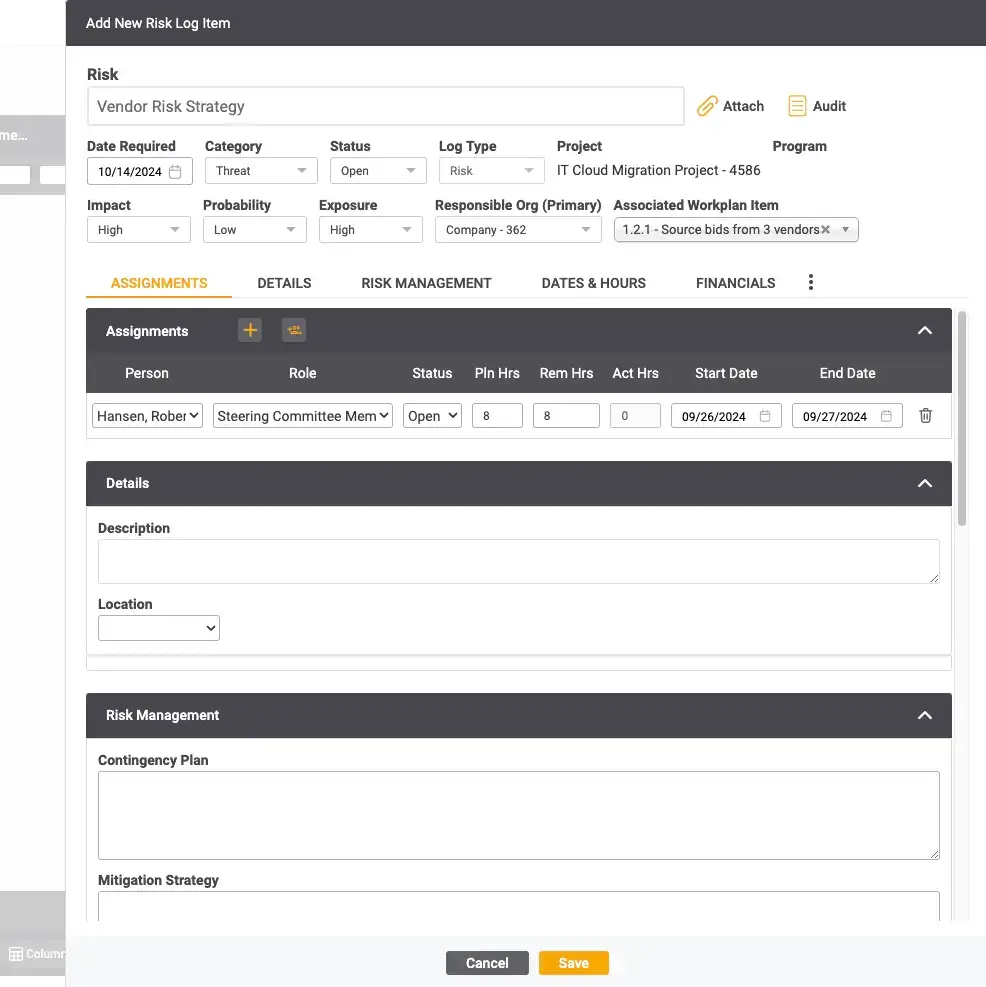

- Risk assessment and mitigation strategies to address potential project blockers might be presented as a risk exposure index or a dependencies risk score which measures the interdependencies of risk among projects

- Resource allocation and utilization across projects and portfolios. Measuring team and tool efficiency is one goal, another is understanding capacity and utilization in support of balanced projects

- In addition to ROI, project investment status may be presented in the form of Benefit-Cost Ratio (total benefits divided by total costs), payback period, or Net Present Value (NPV)

- Project performance across the portfolio or programs can be measured as project success rate, which is the percentage of projects meeting defined success criteria. Another useful measure to to track and report on is the Cost Performance Index (CPI) which is the ratio of budgeted costs to actual costs for projects

- Reporting milestone achievement rate across projects provides executives with a quick look into the overall health of projects under management

- Delivering a summary of opportunities to improve project processes and outcomes can be derived from feedback from project teams, managers and all key stakeholders

- In conjunction with recommendations for improvements, the executive team may also want to understand more about opportunities like what if scenarios for resource planning which can be easily understood with a tool for Project Portfolio Management (PPM)

Every organization is different and will prioritize certain metrics over others. For a Prism PPM customer in the Life Sciences field, being first to market with a new drug or therapy is key to success, so monitoring and reporting on project progress and estimated time to complete is paramount. Using Prism PPM, they track and report on project timelines and progress toward regulatory approval to ensure delivery to market is predictable and achievable.

How to Structure Portfolio Updates for Executives

Just like any form of communication, understanding your audience and what they care about will greatly improve your ability to pass along the most useful information. For executives, who require regular updates but may only choose to get into the details if there’s an issue to solve, portfolio updates should be brief and clear – keep the focus on critical information:

- Progress updates like key milestones reached and overall project status

- Potential roadblocks and other risks and mitigation plans

- Readouts of results that will indicate how projects in the portfolio support business objectives

Knowing your audience entails understanding the KPIs and data that most matter to individuals or groups, while also understanding higher-level goals and objectives the recipient(s) are most concerned with. For example:

- Key Stakeholders and Executives might consume Financial Health reports including ROI, budget variances, and financial risks

- Risk management reports outlining risks, mitigation strategies, and contingency plans might be targeted at CIOs and CTOs as well as key stakeholders

- Resource reporting may be consumed by resource managers, department heads, HR, and/or Recruiting to understand staff and hiring demand and to support upskilling needs

Delivering information is best done with visuals and summaries of complex information. Keep in mind that reporting should cover the current state of all projects in a portfolio or program, potential future risks or opportunities, and upcoming scheduled work as well as work to be scheduled:

- Dashboards with real-time data present insights in a visual format that is easy to consume

- Executive summaries of granular information allow you to distill data into key points, ensuring the most important information is highlighted

- Visuals, like charts and graphs showcase performance trends, resource utilization, and risks, can be leveraged to highlight key insights like overall trends in performance

As important as the delivery mechanism is, it is also crucial to prioritize the content in your reports. Doing so will enable you to “tell the story” in a logical fashion:

- An Executive Summary, including a brief overview that summarizes key findings, is typically first

- Often, progress updates with high-level progress details are then presented

- Progress updates provide a context for current and potential risks and mitigation strategies, which can be outlined as needed

- If applicable for your audience, a section on strategic alignment at both a project and portfolio will provide context for risks and help executives prioritize remediation efforts

- Typically a list of action items or recommendations is presented last to provide a set of next steps or enable a discussion to determine future actions

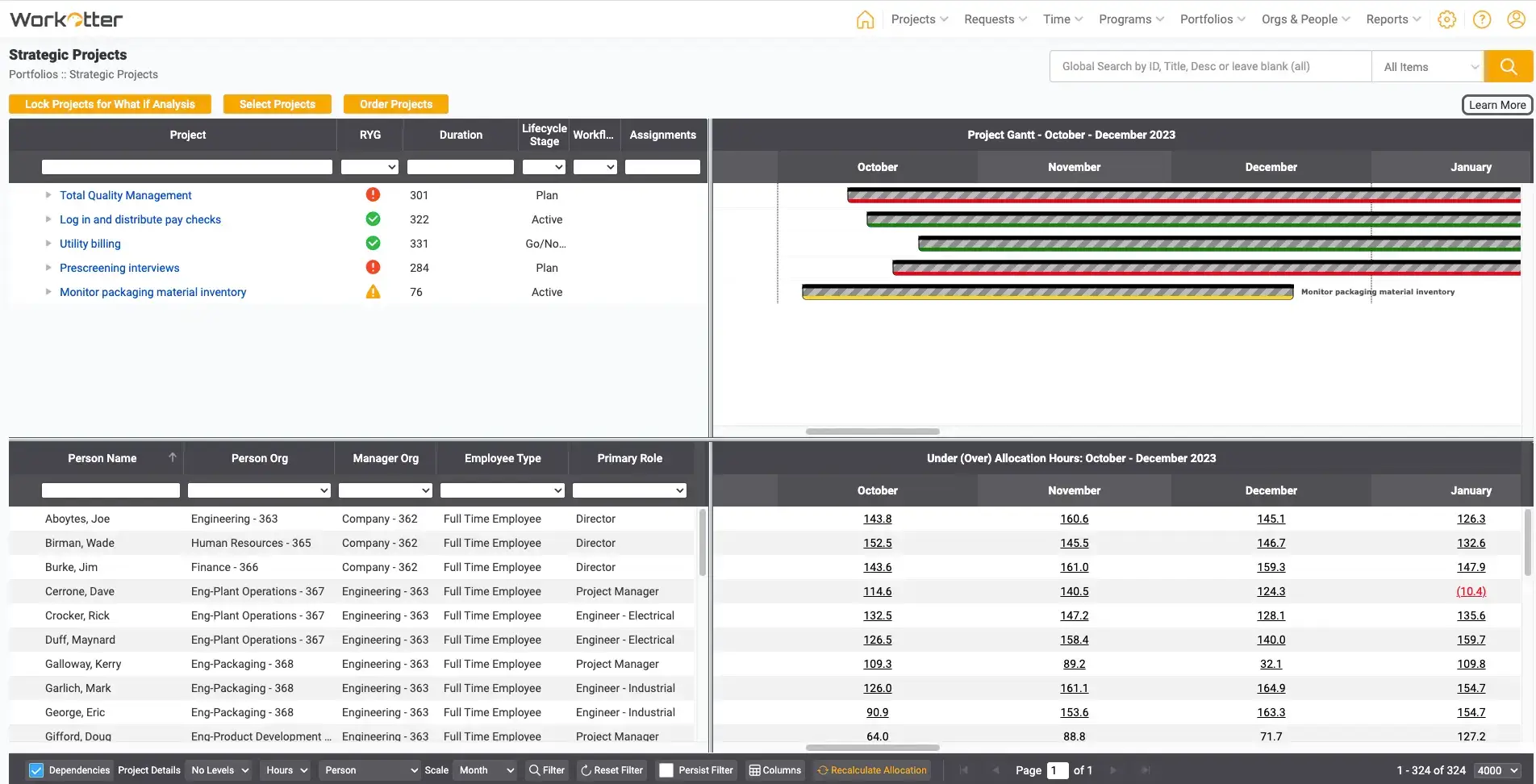

This view of strategic projects delivers a simple view of project health, highlighting projects that need attention

Successfully structuring executive-level portfolio reporting also means avoiding common pitfalls:

- Data overload or too much detail will make it difficult to gain quick insights

- Failing to draw a line to strategic value and goals may lead to the wrong priorities being set or the wrong actions taken

- Overly complex visuals can limit the ability to quickly and accurately digest the information being presented

Manage & Optimize your Project Portfolio with Prism PPM!

Ready to see how Prism PPM solution can help you get better results across every project through efficient resource management, better project controls, and reports that inform everyone from project teams to executive stakeholders? Let us show you how! Get a demo or download our Buyer’s Guide.

What Risks Should Be Highlighted in Portfolio Updates?

According to the Project Management Institute, 90% of project problems can be avoided with proper risk management. This is why executives care so much about risks and risk mitigation. In your reporting, there are three basic types of risk to highlight:

- Financial risks like budget overruns or budget versus actuals where the risk of underspending budget may be at issue

- Schedule risks like missed deadlines, shifts in milestone key dates, and extended project timelines that impact staffing and capacity planning

- Operational risks, including resource shortages and interdependencies among projects that might stall progress or create bottlenecks for managers

Collecting and communicating risks is easier with a tool like Prism PPM which allows collaboration on risk at a project level, and an overall view of risks by project at a portfolio level.

Effective project and portfolio management involves creating and managing risk management plans. As we write about in our blog on project portfolio governance, creating a risk framework should include a plan to ensure executives are aware of current and potential risks proactively. As you develop your risk strategies, regularly update your plans processes to incorporate new information based on feedback from teams and stakeholders.

The best data-driven assessment tools will provide visual risk indicators (like a red-green-yellow traffic light graphic) to quickly and easily communicate where the focus on risk needs to be.

Being proactive in risk assessment is the most important aspect of highlighting and communicating risks. Stay ahead of trouble by addressing potential roadblocks early and offering mitigation strategies to avoid delays, and to keep projects aligned with business goals.

Aligning Portfolio Updates with Strategic Goals

Work with your executive team to determine the value of your projects and the expected benefit. A quantifiable and measurable project intake process will help with this, but so will communication among stakeholders who will need to agree on how best to measure value.

For a Prism PPM customer in the public sector, success means delivering on the mission of their department and also responsibly spending the budgets allocated to given projects. For their projects, delivery and budget vs actual spending are both a continual focus.

Another Prism PPM customer in manufacturing manages a portfolio of IT implementation projects designed to make the business more efficient. For every project, understanding the benefit a given implementation would deliver in terms of hours saved allowed the PMO to prioritize and manage the projects that had the most impact on the company’s operational efficiency and bottom line.

Determining the Frequency and Timing of Portfolio Updates

Discuss how often portfolio updates should be provided to executives: Weekly, bi-weekly, or monthly depending on the size and scope of the projects. Provide guidelines for timeliness and relevance: – Ensure the updates coincide with decision-making cycles (e.g., quarterly board meetings). Offer tips on balancing detail with brevity: – Keep updates short but informative, focusing on high-level insights. – Include only the most relevant data for that reporting period.

How Technology Helps to Streamline Portfolio Updates

There are many options for Project Management tools that will help you manage and deliver. There are fewer good options when it comes to project portfolio management (PPM), and the difference the right tool can make is significant:

-

- A PPM tool automates and simplifies reporting, saving teams from manual data collection and allowing them to focus their efforts on more valuable work

-

- PPM tools also make sure reporting is accurate by using a single source of truth for project and portfolio data

-

- Facilitating collaboration and improving communication between portfolio managers and executives becomes easier when everyone is working from a single tools

-

- Real-time information at a high level, with the ability to drill into details as needed, further enhances trust and collaboration between projects, portfolios, and executives

Prism PPM PPM was purpose-built for project portfolio management, allowing you to more efficiently and effectively manage risks and resources. Other portfolio tools take a bottom-up approach to project data, which can lead to inconsistent reporting at a portfolio level. Prism PPM top-down approach to structured data means every project is built to be easily reported on and rolled up consistently and accurately.

Feedback is Key: Ensuring Executive Expectations Are Met

Executive reporting and portfolio updates should continually evolve based on the needs of your PMO and those of the business. But you can’t improve if you don’t know what’s working and what’s not, and that’s where feedback comes in:

-

- Asking for input on which data points are useful or not will improve reporting

-

- Making changes to report structure or contents based on executive feedback helps the team stay aligned with goals

-

- Starting with a good set of reports and then evolving will avoid information overload

-

- Gathering feedback from all team members, stakeholders, and executives will help when monitoring whether reporting is effective and understandable

Summary

Knowing what executives in your organization want from portfolio updates requires understanding the metrics they want to measure, the formats they find most valuable, and timely and accurate information. Start by tailoring your dashes and reports to track the leading and lagging indicators that show progress toward goals, surface risks and opportunities, and provide context for resourcing decisions. Maintaining project portfolio alignment with strategic goals requires a comprehensive set of measures that will evolve over time as feedback is gathered and incorporated. A PPM tool purpose-built for portfolio management will ensure timely and accurate data, customizable reporting and dashes, and enhance communication and collaboration.

Prism PPM empowers project portfolio managers with customizable reporting and real-time dashes that provide insight into project and portfolio health, risks and opportunities, and resourcing. Book a demo to see how our reporting can work for your organization.

Prism PPM is here to help you understand your choices for Project Portfolio Management.

Our Buyer’s Guide breaks down the various options in the software marketing and provides checklists to help with needs assessment and vendor selection.

We are also available to show you how Prism PPM can help you improve your project outcomes, empower your PMO, and align every project with organizational goals.

Book a demo with us to learn more.